TRX Price Prediction: Path to $1 Analyzed Through Technical and Fundamental Lenses

#TRX

- Technical indicators show TRX trading above key support with potential for upward momentum

- Tron's fundamental strength demonstrated by $23B USDT adoption and record network activity

- Market positioning within evolving RWA tokenization sector provides additional growth catalysts

TRX Price Prediction

TRX Technical Analysis: Bullish Momentum Building Above Key Moving Average

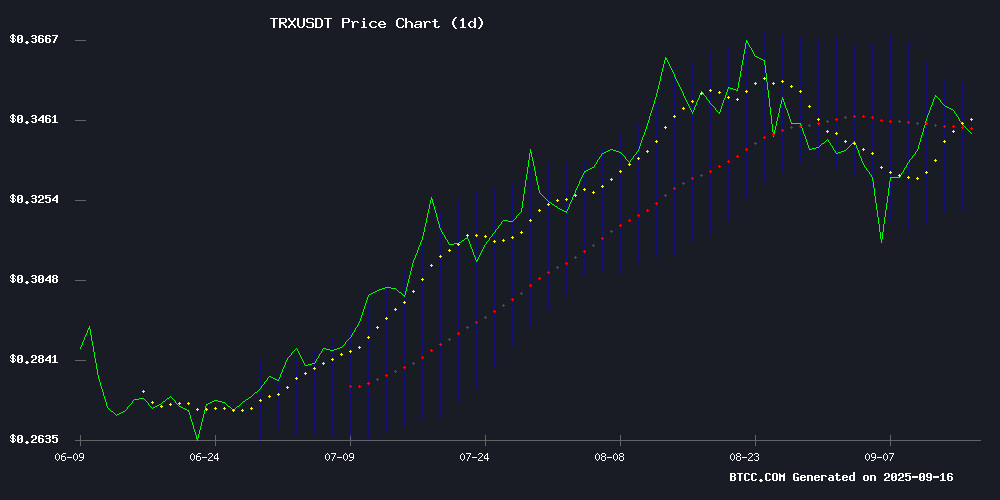

TRX is currently trading at $0.3451, positioned above its 20-day moving average of $0.33914, indicating underlying strength. The MACD reading of -0.004475 suggests some near-term bearish momentum, though the narrowing histogram hints at potential reversal. Trading within Bollinger Bands ($0.32257-$0.35571) shows consolidation, with the price hovering NEAR the middle band. According to BTCC financial analyst James, 'The technical setup suggests TRX is building momentum for a potential breakout if it can sustain above the 20-day MA.'

TRX Fundamentals Strengthen with $23B USDT Adoption and Network Growth

Tron Network's capture of $23 billion in USDT supply represents a monumental achievement in stablecoin dominance, while record block size expansion indicates massive network scalability. The emergence of Solana, Arbitrum, and Base in RWA tokenization creates positive sector momentum that benefits established networks like Tron. James from BTCC notes, 'These fundamental developments, combined with technical positioning, create a compelling case for TRX's medium-term growth trajectory.'

Factors Influencing TRX's Price

Solana, Arbitrum, and Base Emerge as Leaders in RWA Tokenization

Real-world asset (RWA) tokenization is gaining momentum beyond ethereum and TRON, with Solana, Arbitrum, and Base leading the charge. These chains have become hubs for new liquidity pools, showcasing over 800% growth in asset value year-to-date, according to Token Terminal data.

Solana hosts 81 RWA projects, while Arbitrum supports 101 tokenized asset types, per RWA XYZ. BlackRock, Securitize, and Wormhole dominate as top issuers. The tokenized investment funds sector hit a record $7.7 billion in assets under management, with BlackRock's BUIDL fund leading the pack.

Solana's versatility shines with diverse RWAs, including hybrid physical-digital assets like Pokémon cards and Steam items. The chain's NFT experience has paved the way for innovative tokenization markets.

Tron Network Captures $23 Billion in USDT Supply in 2025, Signaling Strong Growth for TRX

The TRON network has emerged as a dominant force in the stablecoin market, with its supply of Tether's USDT surging by $23 billion in 2025. This milestone underscores Tron's growing adoption and its pivotal role in the global digital payments ecosystem.

Data reveals that over 82 billion USDT now circulates on the Tron blockchain, accounting for nearly half of the stablecoin's total supply. The network's rapid expansion reflects its deepening integration with decentralized finance (DeFi) services and its appeal to users seeking efficient transactions.

Market analysts attribute this growth to Tron's robust infrastructure and its founder Justin Sun's strategic vision. The surge in USDT supply aligns with broader trends of institutional and retail adoption, positioning TRX as a key player in the evolving cryptocurrency landscape.

Tron Witnesses Record Spike in Average Block Size, Indicating Massive Expansion

Tron's blockchain ecosystem is demonstrating significant growth, with its average block size reaching record levels. The 100-day simple moving average (SMA-100) has peaked since July 2023, signaling sustained network activity beyond short-term volatility.

Key drivers include surging demand for USDT transfers, broader consumer adoption, and an expanding DeFi landscape. This growth underscores Tron's infrastructure scalability and reinforces its position as a resilient blockchain platform.

CryptoOnchain data highlights the trend as more than a technical anomaly—it reflects a dynamic ecosystem maturing amid increasing utility and adoption.

Will TRX Price Hit 1?

Reaching $1 would require approximately a 190% increase from current levels. While technically possible given cryptocurrency volatility, this target represents significant growth that would need sustained bullish momentum across multiple metrics.

| Metric | Current Value | Required for $1 | Growth Needed |

|---|---|---|---|

| Price | $0.3451 | $1.00 | 190% |

| Market Sentiment | Neutral-Bullish | Strongly Bullish | Significant improvement |

| Network Adoption | $23B USDT | Continued expansion | Ongoing growth |

James suggests that while $1 is ambitious, continued network growth and broader crypto market recovery could make this achievable over an extended timeframe.